By the time you reached elementary school, you probably already did some good-for-you things by habit, from brushing your teeth to tying your shoes and even saying “thank you” (from time to time).

Research backs up early habit making: A lot of it happens by the time we’re about age 9.1 It stands to reason, then, that when it comes to managing your money and saving for goals, the earlier you can figure out what works for you, the better.

The people who’ve been able to accelerate their saving and manage their debts don’t possess any insider knowledge. What they do know is that a couple of habits, started as soon as possible, make a big difference. You can do them, too.

-

Live within (or below) your means.

Small changes do make a big impact over time, and that includes creating a budget and managing your expenses so you’re always spending less than you earn. Changes that might help:

- Drive older vehicles.

- Own a modest home.

- Travel, but travel less.

- Dine out less.

- DIY when possible.

“It’s about making smart financial choices, but not sacrificing quality of life,” says Heather Winston, assistant director of financial advice and planning at Principal®. “We make time for the things we find most important.”

-

Manage your debt.

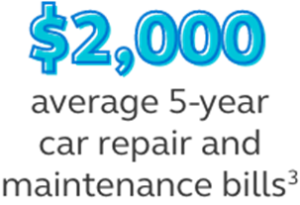

Paying for a pair of jeans you like or a new coat you need can be easy to include in a budget. But saving up for big-ticket items like a car can be harder. A lot of people need to borrow: About 44% require a loan to buy a vehicle.2

So say you have debt—a car loan, a student loan. You’re making room for it in your budget, but you also want to pay it off sooner, if you can. One tip is to always pay off credit card purchases so you don’t carry that debt. (Checking your credit score doesn’t hurt, either. And then choose one of two debt-payoff options to get through those payments quickly:

- Avalanche: Pay off the highest-interest balance first, then the next highest, and so on.

- Snowball: Pay off the smallest balance first, then the next smallest, and so on.

-

Plan for retirement.

Many people who’ve accelerated retirement savings put away about 15% of their income. Sounds like a lot, right? But they started as early as they could—their mid-20s—even if it was just a little. These four strategies may help you gradually get to that goal.

- Get the (free) money. Save enough to receive the maximum employer match in your retirement plan if offered.

- Increase your retirement savings, at least by 1%, each year or when you receive a raise.

- Work your way up to 10%–15%. It might take you a few years. That’s OK.

- Check your progress at least yearly. Rebalance your funds if needed or consolidate if you have previous savings that you can roll into one account.

“One way to look at it is to treat saving for your future like another bill you pay each month,” Winston says. “Automatic withdrawals from

your paycheck to your retirement account allow you to pay your future self, first.”

-

Save for emergencies.

Would a $500 expense throw off your budget in a big way? “If the answer is yes, it’s a good idea to set up an emergency fund,” Winston says. “That way, the unexpected doesn’t derail your long-term plans.”

Several months of income is generally the advice for an emergency fund, but just starting with something—even $100 a month—helps create that savings habit. Add to it gradually as you’re able, including lump sums, to build toward three to six months of savings for unexpected events.

-

Keep learning about money.

Those early, easy habits can help you lean into learning about how to achieve bigger, long-term financial goals. Do you want to own a second home, for example? Take big yearly family trips? Retire early? There are lots of ways for you to build on your skills. (You went from teeth brushing to living on your own, after all.)

“Education drives confidence, and confidence drives action,” Winston says. “Even investing a small amount of time learning more about personal finance may provide a huge boost to your self-confidence in financial decision making.”

Source:

https://www.principal.com/individuals/build-your-knowledge/5-lifelong-financial-habits-anyone-can-do