Understanding your credit score. How Credit Score Affects Your Mortgage Rate

Credit scores directly impact mortgage interest rates. Without a high credit score, you won’t qualify for the best mortgage rates available. This could mean you’ll end up paying more money over the term of your mortgage. Read more to learn about understanding your credit score.

Why your credit score matters to lenders

Along with a low debt-to-income ratio and a strong financial history, you’ll need a high credit score for the lowest mortgage rates. Why? Numbers don’t lie. Decades of collected data proves that higher credit scores equates to less risk of default. They reward that with lower interest rates. That does not mean that you can’t get a loan with a lower score. You may pay more for a mortgage loan.

Understanding your credit scores are important but you must have the whole package: income, sufficient assets and credit.

If you are preparing to take out a loan to buy a home and want to know what lenders will see when they pull your credit, it’s important to know how to access your credit reports.

Under federal law, there are three major credit agencies — Equifax, Experian, and TransUnion. These three entities are individual companies and do not share information between them. Your credit score is calculated with the FICO scoring model and is derived from the information on your credit reports, which are compiled by credit reporting companies. Your reports include your payment habits, amount owed, and length of history with borrowed money.

Understanding your credit score: Here are some of the best ways to build your credit score.

- Make payments, including credit cards and car loans, on time. This is 35% of your credit score so you can see how important this is to the health of your credit.

- Keep your spending to no more than 30% of your limit on credit cards. This is also known as credit utilization. Data shows individuals that have their credit cards close to their credit limits default at a much higher rate, thus have a large effect on your credit scores. So, pay down high-balance credit cards and consider balance transfers to free up credit.

- Check for any errors on your credit report and work toward fixing them.

- Avoid applying for new credit when you are purchasing a home. Credit inquiries and new credit can drive down your credit scores.

- Be careful about closing old credit cards. This can shorten your credit history and temporarily lower your scores.

Understanding your credit score: Is Everyone Eligible to Receive a Free Annual Credit Report?

Under federal law, each consumer is granted one free credit report each year from the three major credit reporting bureaus. Annualcreditreport.com is the only free and government mandated site available from which to receive your free annual credit report from the three reporting agencies.

By visiting the website annualcreditreport.com, you can request your credit files from Equifax, Experian and TransUnion. You should obtain your individual credit file annually, so you can comb through it and catch any potential problems that the reporting agencies may not have caught regarding identity theft or fraud. Remember, that you can only get one credit agency report per year for free. If you want all three or credit scores it will cost, your money.

It is up to you to review and dispute or request changes to your credit report through the three credit agencies.

Understanding your credit score: Do All Three Credit Bureaus Have the Same Information?

Because these private companies do not share information with each other, each one may tell a slightly different story about your finances and credit standing. That includes information about your credit cards, banks, mortgage companies and other lenders. Each credit agency uses the FICO model but have their own twist to the model and that is one of the reasons your credit scores are different with each agency.

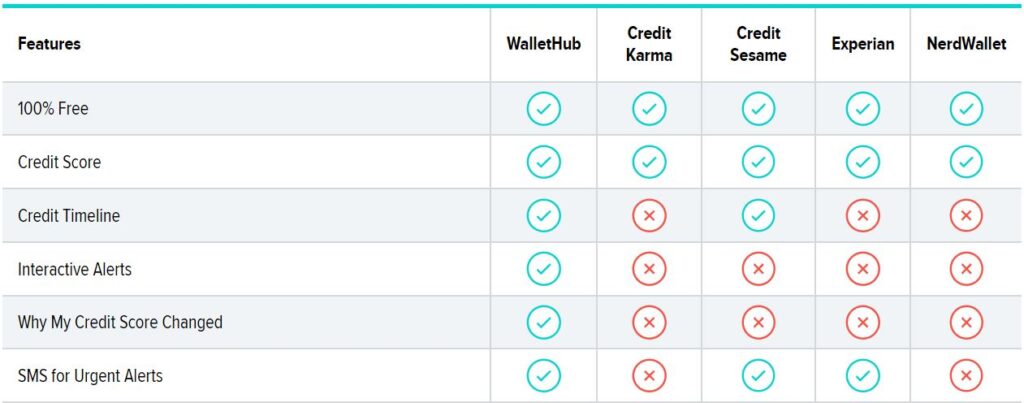

If you’d like to check your credit reports as they are regularly updated, you will most likely have to subscribe to a credit monitoring service, for which some are free and others that may have a recurring fee for the credit monitoring service. Click here to see examples and descriptions of credit monitoring services.

Investigate which credit monitoring system is best for you.

Your standard credit report can be accessed by lenders after a permissible purpose and will show the credit information the lenders need to know about when making a decision about your credit worthiness. You can start the process of applying for a mortgage loan here.