One of the biggest reasons holding potential home buyers back is education and cost. EducateHomeBuyers.org holds “free” virtual classes to help folks understand the process and takes the anxiety out of the purchasing a home. There are many individuals and …

ShopTalk

It is important to understand the typical costs when selling your home. Many real estate professionals will be happy to give you a Market Analysis on your home to establish value. If you ask, they will also give you an …

I read an online article today at Bloomberg that said at the end of 2020, more than 30% of U.S. homeowners were considered equity-rich — meaning their property was worth twice as much as the underlying mortgage.

Helped by low …

Millionaires Found Most Built Wealth Slowly Over Time Using a Basic Tool Many Americans Overlook

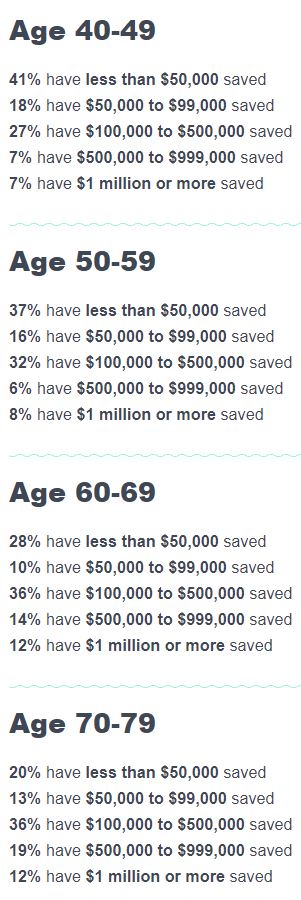

An article written by Liz Knueven at businessrider.com really hit home for me and I think this message needs to get pushed out to as many people as possible. Reports show that 40% of retirees are living solely on social …

An article written by Liz Knueven at businessrider.com really hit home for me and I think this message needs to get pushed out to as many people as possible. Reports show that 40% of retirees are living solely on social …

Everything You Need to Know About Finding an Accessible Place to Live

Image via Unsplash

A comfortable and supportive environment is something we all want in our homes. However, finding accessible housing that fits the bill can be tough. Read on as we explore some simple strategies that can help you score …

The mortgage lending industry does not want to ever hear this statement again, “I don’t know what kind of loan they gave me.” Since 2008, we have experienced a flood of new regulations and disclosures. All of them to  benefit …

benefit …

Here at EducateHomeBuyers.org we work to provide you with the most current information on purchasing, selling and refinancing your home. Our objective is to help you make smarter financial decisions.

Private Mortgage Insurance, or PMI, is something that few homebuyers …

Two Reasons Why People are Buying a Home in the Middle of a Pandemic!

Someone just sent me a joke and I think it is worthy of sharing since this year is one for the record books (in a bad way). If 2020 was a math problem, it would go like this…….If a canoe …

8 Ways to Save Money to Buy a Home When You Can’t Really Afford Too

Knowing you need to save money is one thing, but making it happen requires some extra effort. After all, your paycheck won’t automatically move itself into your savings account. Only you can take the required steps to set

aside some …

Very few home buyers consider sewer inspections before buying a home. They know they should get a home inspection, but  the sewer line is almost an afterthought. Yet this is one of the most important inspections a buyer of an …

the sewer line is almost an afterthought. Yet this is one of the most important inspections a buyer of an …

Reserve your place at the next Home Buyer Education Workshop. Just fill out the the form to sign up.

*Be sure to list everyone attending on the names of everyone attending.

Categories

Archives

- February 2026

- January 2026

- December 2025

- October 2025

- September 2025

- June 2025

- April 2025

- February 2025

- January 2025

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- January 2024

- July 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- September 2022

- August 2022

- July 2022

- June 2022

- February 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

Tags

You provided a wonderful class! I have attended others in the past but yours was much better. Very enjoyable.

– Patty, Tacoma, WA

Your workshop had so much information. Your experiences helped us better understand the process. I am so excited to get started now that I clearly understand the process.

– Lee, Federal Way, WA

Would you recommend this class to a friend? “Yes, everyone should take this course!”

– September 8, 2018

371 NE Gilman Blvd, Suite 340, Issaquah, WA, United States | +1.206.650.4202

Curt Tiedman | Loan Consultant | NMLS# 35554 | Cell: 206.650.4202 | 821 Hiawatha Place S, Suite D, Seattle, WA 98144

NewRez Home Loan Division | NMLS ID #3013 (www.nmlsconsumeraccess.org) |

![]() Equal Housing Lender.

Equal Housing Lender.

This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates, and programs are subject to change without prior notice. All products are subject to credit and property approval. Not all products are available in all states or for all dollar amounts. Other restrictions and limitations apply. This site is not authorized by the New York State Department of Financial Services. No mortgage solicitation activity or loan applications for properties located in the state of New York can be facilitated through this site. Washington Consumer Loan Company License No. CL-15622.