Millennials are struggling to come up with a down payment and closing costs to buy a home. Many have great jobs and steady incomes but still are having a difficult time saving enough money.

Millennials are selling practically anything not bolted down to raise cash and are even tapping into retirement accounts for down payments. Others have moved in with family or friends to cut rent and save money. All of these sacrifices are to build savings for down payments on fast-rising home prices.

Down Payment Dilemma for Millennials

A mere 37% of millennials (ages 23 to 38) own homes, and their attempts to raise cash for down payments reflects their dire housing situation. Nearly half of millennials — 45% — polled by Bankrate.com that the high cost of living has held them back from buying a home.

Down Payment Cash Drained By Student Loan Debt

Another hurdle is student loan debt for millennials than older generations. Among millennials, 23% cite it as a roadblock, vs. just 15% of Gen Xers and 5% of boomers.

Income in particular — not earning enough of it — is seen as a barrier by all age groups. While 52% of millennials said their income simply is not high enough, insufficient income was cited as a problem by 54% of Gen Xers and 55% of boomers.

It’s Time for an Old-School Solution: Save, Save, Save

Millennials main solution for coming up with enough greenbacks to make a down payment is an “old school” solution – save, save, save!

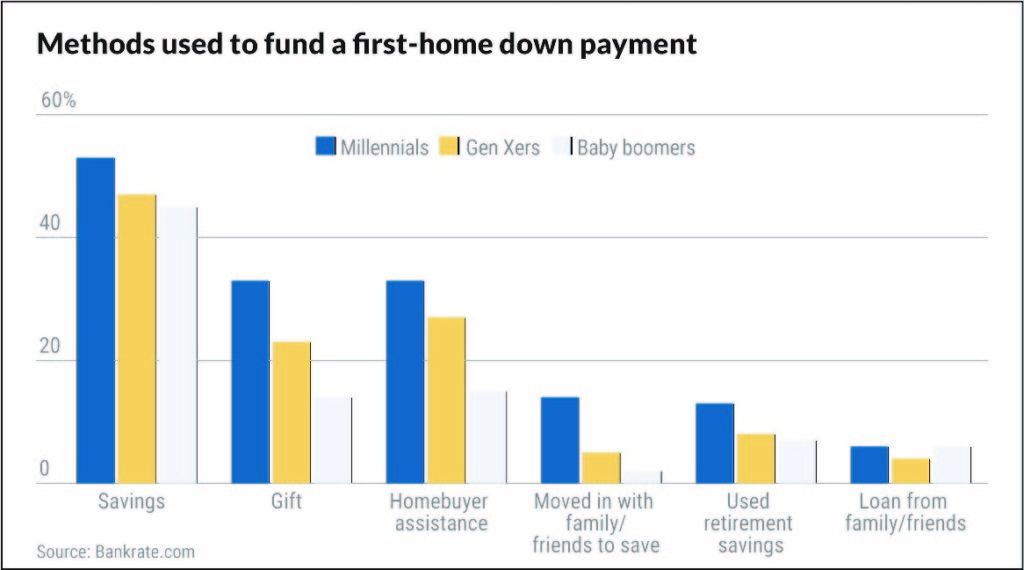

Fifty-three percent of millennial homeowners cited old-fashioned scrimping and saving as one way they set aside enough for a down payment. In contrast, just 47% of Gen Xers said that’s how they saved enough, and merely 45% of boomers cited saving.

Creative Solutions for Down Payments on a House

Yet many millennials have shown impressive creativity in finding many ways to save for a down payment. See the image below on how different generations are handling the sourcing of funds for a down payment.

How To Use Down-Payment Assistance Programs

Washington down payment assistance is not for everyone because there are income limits and other qualifications. You will be surprised that you may fit and can get into a home quicker than you thought.

Don’t forget home grant options like HomeStarGrant.org to get more funds for closing costs. These funds can be used to help buy-down the interest rate, or cost of PMI (Private Mortgage Insurance), or just reduce out of pocket closing costs.

Start with home buyer education! Attending one of our accredited classes like ours can help you make better decisions. Check our Class Schedule for one that is convenient one for you.